How to Handle a Car Rental Dispute in Dubai & Get Your Deposit Back

Still no update on the deposit refund after weeks of returning your rental car in Dubai? It’s even more frustrating when the rental agency ignores your emails and messages. Is there no proper way to get a deposit back? Don’t worry. This blog explains how to handle a car rental dispute in Dubai and get your deposit back. Furthermore, it elaborates on consumer rights Dubai, recovery tips, and preventive measures to avoid future disputes. Let’s first, see the common reasons behind it. Rental disputes in Dubai primarily trace back to agencies' shady schemes: hidden fees, hefty deductions, or no return. However, renters can also inadvertently contribute to disputes. Let’s take a look at some common reasons for deposit disputes: Delayed or withheld deposit refund beyond the agreed-upon timeline. Unfair damage charges, often for pre-existing issues. Undisclosed service charges or hidden fees not mentioned at the time of rental. Traffic fine handling discrepancies and administrative fees. Disputes over insurance coverage and claims lead to unexpected costs. Fuel policy disagreements, such as returning the car with less fuel than required. Mileage policy disagreements, where the renter disputes excess mileage fees. Undisclosed maintenance issues or breakdowns caused by the renter. Misunderstanding of rental contract terms and conditions. These issues highlight both agency and renter as root cause for disagreements; not a sole party is responsible for car rental issues Dubai. Make sure you’re not in the wrong. As a car renter in Dubai, understanding your consumer rights is crucial for navigating potential disputes and ensuring fair treatment. These are the fundamentals you must be aware of as a consumer in Dubai: Federal Law No. 15 of 2020 mandates contract transparency. It requires rental agencies to clearly state deposit terms, fees, and refund conditions. Dubai Car rental agencies must return credit card holds (deposits) within 30 days of vehicle return. Furthermore, companies must cover any transaction fees incurred per Circular No. (1) of 2024 from the Dubai Corporation for Consumer Protection and Fair Trade. It only allows deductions for verified traffic violations, damages, or administrative fees. You have the right to file a formal complaint against your rental agency via the Dubai Department of Economic Development (DED) Consumer Protection Unit website. It investigates complaints about unfair practices, such as unjustified deposit withholding. All car rental agreements are legally binding. This means agencies must provide evidence for deposit deductions (e.g., traffic fine receipts or vehicle damage evidence). The UAE consumer protection safeguards renters, ensuring fair treatment and preventing agencies from taking undue advantage. Always retain all your contracts and communications records. These documents will be vital evidence to support your complaint with DED, if your agency fails to refund your deposit amount within 30 days. Knowing your rights and Emirates’ consumer protection laws is a solid foundation for handling Dubai car rental disputes. However, enacting them in real life is more important. Here’s a step-by-step guide to resolving car rental dispute Dubai: How to handle a car rental dispute in dubai and get your deposit back: Review the Rental Agreement Gather all Existing Documentation Initiate Formal Written Communication with Rental Agency Consider a Bank Chargeback File a Formal Complaint with DED Cooperate Fully with the DED Investigation Consider Further Legal Avenues Note: You must wait at least 30 days for your refund. Agencies legally can hold refunds for a month as per the Circular No. (1) of 2024. Take these actions if the agency doesn’t address the refund issue within this time frame. Go through your rental agreement thoroughly to verify all clauses related to security deposits, potential charges, and refund procedures. Make sure you understand what the agreement outlines and if your demand for a refund is contractually supported. Search through communication histories and documents exchanged digitally or physically. Retain them all and compile everything related to your rental, from payment receipts to WhatsApp messages and fine payments to bank statements. Every little evidence is important to support your claim and complaint against your agency. Once you have the required documents and evidence, you must first write a formal email to the rental agency, informing them that you will proceed with filing a complaint with DED if they delay refunds, ghost your communication efforts, or charge hidden fees. It’s a chance for the agency to make everything right without any legal consequences. For credit card payments (security deposit withholds), you can request a chargeback with your bank. It’s typically useful if the agency unfairly withholds your deposit or remains unresponsive. Most banks allow chargebacks within 120 days. Acting quickly can be very crucial, providing all that is requested by your bank. It can eliminate DED complaints and legal involvements. If the bank chargeback is of no avail, or security deposit was made with a different gateway, proceed with a formal consumer complaint with DED. You can easily do this from their website. Accurately filling the complaint form with personal information, company details, and a detailed description of the dispute is important. Attached all the communication and evidence you gathered in step 2. Ensure you receive and keep your complaint reference number for future follow-up. DED will contact you for confirmation, verification, and several other reasons as it initiates the investigation. Stay available and reachable at all times, replying to their requests for additional information and clarification. They may act as a mediator between you and the agency in some cases. Be prepared to present your case with evidence, precisely and concisely. Adhere to any DED-issued instructions or decisions regarding the resolution of your dispute. If your car rental dispute remains unresolved, you need to consider further legal assistance to get your car rental deposit back. It’s your last resort if the DED complaint process doesn’t satisfy your expectations. Consult with a lawyer specialized in consumer or contract law in Dubai. Understand the feasibility, costs, and process of pursuing a claim through the Dubai courts. Proceed if you think it’s worth your time and money. Being safe rather than sorry is always better in any situation, including renting a car in Dubai. Staying updated and informed is a good start. Furthermore, implementing theoretical knowledge in practice is perfect to stay ahead of the curve. Here are some useful tips and preventive measures to recover your deposit and prevent future disputes: Always pick reputable rental companies with transparent policies, pricing structures, and strong reviews on Google and review sites. Avoiding local agencies with vague policies is a very good place to start. Go through the rental terms and agreements. Look out for potential flaws that can come back and haunt you later. Make sure you know what you’re getting into. Don’t sign the agreement unless you’re completely satisfied. You’ll always find a better agency in Dubai. Leverage credit card payment to take advantage of the chargeback option if everything goes south. Make sure you adhere to all the rental policy-outlined rules and regulations. Don’t give agencies to charge your extra fees for late returns, overage mileage limits, or fuel policies. Adhere to all the UAE traffic fines and make your rental fine-free. This eliminates monetary transactions: fines and administrative fees related to traffic, simplifying the refund procedure. Always document everything related to your rental. Keep the payment receipts, emails, or WhatsApp conversations preserved. Don’t delete or discard them until you receive your refund back. Verify the traffic fines and salik tolls yourself, if possible, so that you know agencies are not overcharging you. Use the RTA website and mobile apps to do so. A little bit of help from the web can be very useful. If you’re involved in a car rental dispute in Dubai, keep calm and handle the situation professionally. Maintain a respectful tone and try resolving the issue to prevent escalation. If you’re in the wrong, admit it and pay for the consequences. Maintaining a polite and professional tone can sometimes lead to more lenient charges. Demand all deductions and payments made in written format. Email can be a suitable option—easy to document and download, if needed. Car rental disputes in Dubai, resulting in deposit withholds, are rare but possible. Acting mindfully and strategically is the only way to navigate through these disputes and get your deposit back. Knowing your rights and the UAE consumer laws is equally important to react responsibly to agencies not return your deposits on time or unfairly deduct money. Follow the above-mentioned steps chronologically and get your refunds back without spending a dime. Stay informed, know your rights, and act professionally to tackle Dubai car rental disputes with ease. Note: Most Dubai car rental agencies at present offer rentals without a security deposit, eliminating stress and conflicts of deposit refunds and deductions.Dubai Car Rental Disputes: Top Issues

Understanding Your Rights as a Consumer in Dubai

Step-by-Step Guide to Resolving a Car Rental Dispute

1. Review the Rental Agreement

2. Gather all Existing Documentation

3. Initiate Formal Written Communication with Rental Agency

4. Consider a Bank Chargeback

5. File a Formal Complaint with DED

6. Cooperate Fully with the DED Investigation

7. Consider Further Legal Avenues

Tips to Recover Your Deposit & Prevent Future Disputes

Conclusion

Written by: FriendsCarRental

Published at: Mon, May 26, 2025 2:08 PM

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

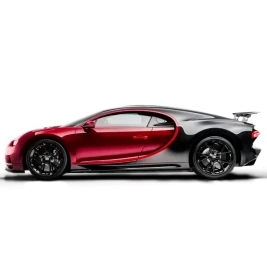

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana