Insurance Policies for Rental Cars in Dubai

Exploring Dubai in a luxurious rental car is an amazing experience. Only a handful of experiences can match the feeling of Dubai's vibrant atmosphere in your dream car. However, for a peaceful driving experience, it's very important to take rental insurance into account. In this article I will explain the various aspects of insurance policies for rental cars in Dubai. By the end, you will have a comprehensive idea of how and which insurance policies to choose for your rental in Dubai.

Types of Car Rental Insurance

Let's first understand Dubai's car rental insurance scene. Different rental companies may have different insurance policies. But in accordance with the UAE's law, every rental company should provide basic third-party liability insurance. All other insurances are optional.

Mandatory Insurance:

Third-party liability insurance (TPL)

Liability insurance (a third-party liability insurance policy) is the only mandatory insurance in the UAE. All rental companies include this policy in their rental prices. It protects you from the property damage and physical injuries caused by your car.

This insurance doesn't cover any legal fees that may arise from lawsuits. Lawsuits are possible as a consequence of the accident.

Additional Coverage:

Collision Damage Waiver (CDW)

The collision damage waiver (CDW) is one of the most popular insurance policies in Dubai's car rental landscape. It covers your rental car's repair and damage costs.

However, the CDW comes with limitations. Most CDW policies have deductibles (sometimes called excess). You need to initiate taking care of the damage first; only then will the CDW kick in. You might need to pay a certain portion of the damage yourself.

Loss Damage Waiver (LDW)

It is another optional insurance policy. The loss damage waiver (LDW) is similar to the CDW. It also covers damage repair costs for your rental car. Furthermore, it protects you against car theft or vandalism.

Just like the CDW, the LDW also comes with deductibles. If a claim is made, you are responsible for covering the costs. The insurance policy comes in later to reimburse a pre-agreed portion of the sum.

Personal Effects Coverage (PEC)

The PEC, also known as personal belongings coverage, is an additional insurance policy. If your belongings become lost, stolen, or damaged while in the car, it offers you financial protection.

Your valuables must be in the car for the claim. Similar to CDW, it may come with deductibles (excess), depending on the insurance provider's policy.

Personal Accident Insurance (PAI)

Personal accident insurance (PAI) can be useful if you or your passenger suffer physical injuries. The PAI covers all your medical expenses, hospital bills, and ambulance services. It also provides coverage for the accidental deaths of both the driver and passengers.

Some PAI policies can also offer benefits for permanent disability as a result of an accident.

Supplemental Liability Insurance (SLI)

For better coverage, people add the SLI as an additional insurance policy to their mandatory liability insurance. It typically covers costly third-party property damages. This policy extends the limits of TPL coverage.

Rental Insurance Costs and Their Influencing Factors

For your rental in Dubai, the six (6) insurance policies mentioned above are available. They come with different price tags, depending on several factors. In the following sections, let's discuss those factors:

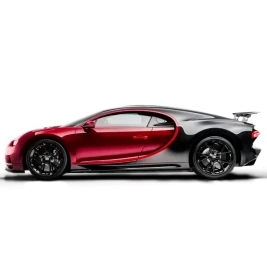

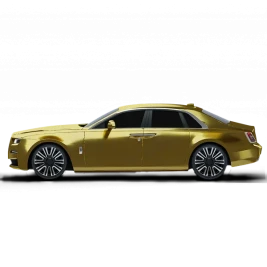

Types of vehicles

Rental car insurance costs are directly proportional to the rental vehicle's level. High-end luxury cars, sports cars, and supercars have higher insurance costs. Conversely, the insurance costs for economy cars are lower.

Rental duration

Insurance policies are bought for as long as the rental duration. A longer rental duration means a higher insurance cost. Rental companies might offer a better rate for long-term rentals.

Driver's age and experience

The structure of insurance policies allows for higher premiums for young and newly licensed drivers. If you have a recently obtained license, you might experience a surcharge.

Second driver

The number of drivers in the rental can also affect the insurance price. Having a second driver can lead to an increase in price. Please check with the rental agency.

How To Choose The Right Car Rental Dubai Insurance?

Choosing the right car rental insurance in Dubai can be a difficult task. Lack of prior experience further complicates the process. When selecting the ideal rental insurance, consider the following:

Compare rentals and their insurance policies

It's best to rent a car from a rental company that offers a wider range of insurance options. Choose companies that provide more cost-effective insurance options. Shortlist the top rental companies that offer your desired rental car at a good rental rate.

To learn more about their insurance policies, reach out to them. Note down the details of the insurance from each company and compare them side-by-side. Pick the company and insurance that resonate with your requirements the most.

Understand the terms and conditions

Insurance policies can have several folds. Going through the fine print is very important. You should understand the insurance policies down to the tiniest details. Once you know what you are getting into, it becomes easier. Never rush; always focus on making an informed decision.

A little bit of research and study offers peace of mind throughout your rental period. Knowing the consequences beforehand is very important. If an unfortunate event occurs, you already know what steps to take and what aspects of it the insurance policy will cover.

Verify your current policy

If you have active insurance policies, you should check to see if the insurance you are trying to get serves the same purpose. If that's the case, you shouldn't waste your money. Buy insurance policies that you don't already have.

Seek expert recommendations

The opinion of someone who has already experienced the situation can be very valuable. If you know someone, you can seek their opinion. You can gain a preliminary understanding of which insurance policies are suitable for you.

You also have the option to talk to the insurance provider directly. Contact them and get answers to all your questions. They can offer you a good insight into their insurance's benefits and limitations.

Considerations Before Purchasing Your Rental Insurance

Once you've conducted research and gathered enough information, it's time for you to make your decision. You've done so much already; you cannot make the wrong choice. However, we recommend considering the following aspects before making the purchase:

Make advanced rental reservations

Advance reservations offer you ample time to research and make an informed decision. You don't need to rush your decision. Take your time to figure out the best insurance policy for your rental car.

Most rental companies allow you to cancel your advanced reservations with a full refund. If you find a better insurance option with a different service provider, you can easily make changes.

Take your budget into account

Your budget makes a major difference when choosing your rental car insurance. It's not possible to purchase policies that are out of your budget. You can either manage your budget to include the insurance policies you want or compromise on them.

If possible, we recommend that you manage a sufficient budget. You should have comprehensive insurance policies for a stress-free driving experience. Compromising on the insurance policies should be your last resort.

Situation-oriented insurance selection

Making a decision with your full conscience is absolutely vital. It's always wise to pick insurance policies that complement the situation. For instance, a loss damage waiver (LDW) and personal accident insurance (PAI) can be good choices for comprehensive coverage.

Having personal effects coverage (PEC) can be suitable in areas that are prone to burglaries and theft. This does not imply that Dubai has such areas. It's just a situational example to show how to pick the correct insurance based on the situation.

Negotiation with the rental agency

Negotiation with the rental companies can help you land better deals. These companies have the authority to alter rental insurance policies and prices whenever needed. To get the best value for your money, negotiate with them.

Don't shy away from asking for discounts and offers. You never know if you are in luck. Even if you get a 10-15% discount on the rental insurance policies, you will save a notable amount.

Situations That Can Void Your Rental Insurance Policy

Rental car insurance policies can become void in certain situations. In such a situation, you won't get any coverage. You must know about this. Their terms and conditions explicitly address this. Let's look at some of the prominent ones:

- Accidents caused while driving under the influence of alcohol or drugs can completely void your rental insurance.

- If rental companies discover your reckless driving or intentional damages, you will be responsible for covering all costs. Insurance policies will be invalid at this point.

- Explicitly disobeying the rental agreements can also lead to void insurance policies. For instance, if you drive your rental off-road, the car may sustain damage. You will be responsible for such damage repair costs.

- Misusing the rental car is also a reason for the insurance policy to be void. If you use the car for illegal reasons, your insurance policy will automatically become null. You cannot claim the insurance.

- Failing to report the accident to the authorities and the rental agency as soon as possible can also nullify your rental insurance. Make sure you notify both parties and report the accident on time.

Rental policies can vary from one service provider to another. To learn about each one, make sure you read them thoroughly.

Tips To Protect Yourself During Rental

Insurances are your shield to minimize monetary losses after an accident. They are an ideal solution in the aftermath. But avoiding accidents should be your priority.

Inspecting the vehicle

You should always check your rental before picking it up. Inspect for faults and check if everything is functioning well. A little inspection can help you avoid a dangerous accident. It's a good opportunity to record the scratches and dents, too. This record will assist you in avoiding unnecessary damage repair issues with the rental company during drop-off.

Safe and secure driving

You should be a defensive driver at all times. Don't ever drive in a rage. Keep a cool mind and drive with care. Enjoy the drive; don't rush. Take your time, and be safe. Your safety matters the most. Living another day is the way to enjoy this beautiful life we've got.

Adhering to traffic rules

Adhering to traffic rules while driving your rental in Dubai solves 99% of the accidental problems. Despite the unpredictable nature of accidents, everyone can avoid them by adhering to traffic rules. Learning the rules by heart is important before renting a car in the Emirates. Dubai's traffic rules are easy to comprehend. Also, the penalties for violations are severe, so everyone is always in check.

Conclusion

A car rental insurance policy is an integral aspect of Dubai car rental. Insurance is the best solution after an unfortunate incident. It allows you to fully enjoy your rental experience. However, they come with several intricacies. Before purchasing them, you should be careful and do thorough research. Having said that, insurance is just a solution, not a precaution. Driving safely and following traffic rules is absolutely necessary while renting a car in Dubai.

Choose FriendsCarRental to enjoy rentals unlike anywhere else in the Emirates. We'll let you rent your dream car in Dubai with your preferred insurance policies at the most affordable rates.

Written by: Friends Car Rental

Published at: Tue, Oct 29, 2024 1:04 PM

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana