25 Most Asked Questions About Car Insurance in Dubai

Navigating Dubai’s futuristic road networks demands more than a sleek car, it also mandates optimal protection—car insurance. Dubai car insurances more than just RTA-mandatory legal formalities, they are your safety blanket against financial losses during unfortunate events, like accidents, damages, thefts, vandalism, and natural calamities. But with unique regulations and diverse options, are you truly prepared? Don’t worry. Our comprehensive Q&A answers the 25 most asked questions about car insurance in Dubai, covering costs, coverage, claims, and expat-specific needs. Let's decode Dubai's car insurance landscape to ensure you're covered, confidently.

Understanding Car Insurance in Dubai

What is car insurance and why is it mandatory in Dubai?

Car insurance is legally binding contract between a car owner and an insurer, providing financial coverage against vehicle damages or related liabilities on the road (like accidents), fire, theft, or natural disasters. This financial protection comes for a specified annual premium.

Car insurance, especially a Third-Party Liability (TPL) is mandatory in Dubai for three major reasons. They are:

Legal Requirement: UAE Federal Law mandates compulsory Third-party Liability insurance for all vehicles in the Emirates.

Financial Protection: Protects the driver (first Party) from out-of-pocket expenses, covering third-party damage repairs, injuries, and property losses.

Public Safety: Insurances cover all expenses of the affected party during accidents, which ensures well-being of the injured party. While not directly related, insurances aid in risk management and stability by pooling risks and providing a framework for compensation.

What types of car insurance are available in the UAE?

In Dubai, there are primarily two types of car insurance policies and an additional Sharia-compliant option for vehicle owners.

Comprehensive: These are broader insurances that are not mandatory in Dubai, but definitely recommended, especially for new drivers. They offer the most extensive coverage.

Coverage: Accidents (even when at fault), theft, fire, vandalism, natural disaster, etc, depending on insurance type. Also, includes TPL.

Exclusion: Intentional damages, car modifications, off-road, unless add-ons are active.

Third-Party Liability (TPL) Insurance: TPL is the minimum insurance requirement for all vehicles in the Emirates.

Coverage: It covers damages and injuries you cause to other vehicles, property, or individuals (third parties) in an accident, if you are at fault.

Exclusion: Your vehicle damages and injuries in an accident.

Takaful: Sharia-compliant insurance, where fund pooling is the source, adhering to Islamic finance laws. It is offered by Salama in Dubai.

Cost and Savings

What factors affect the cost of car insurance?

Several factors affect the cost of car insurance. Car insurance costs in Dubai depend on:

Vehicle Type: Luxury cars (e.g., BMW) cost more (AED 2,500-5,000/year) than non-luxury cars (e.g., Toyota) which cost (AED 500-1,500/year).

Driver Profile: Age, experience, and claims history impact premiums.

Coverage: Comprehensive (AED 1,500-3,500) is pricier than Third-party (AED 800-1,200).

No Claims Discount: Up to 30% off for claim-free years.

Deductible: A higher deductible can lower your premium.

Note: Compare quotes on Lookinsure for the best car insurance UAE.

How can I reduce my car insurance premium in Dubai?

There are several ways to reduce your car insurance premium in Dubai. To get cheap car insurance Dubai, try:

No Claims Discount (NCD): Earn up to 30% (or more for longer periods) off for no claims.

Safety Features: Install anti-theft devices or advanced safety features in your car to lower rates.

Compare Quotes: Use Lookinsure or InsuranceMarket.ae for cost-efficient deals.

Higher Deductibles: Agree to pay more upfront per claim to significantly lower your premium.

Clean Driving Record: Zero accidents and violations is key for lower long-term costs.

Note: Review policies annually to save up to 20% with insurers like Sukoon.

What is a no-claims discount and how does it work?

A No Claims Discount (NCD) or No Claims Bonus is a discount scheme on car insurance premiums in Dubai, where insurers reward the policyholders (who have not made any claims during a specified period, typically a year) by reducing the cost of insurance over time.

How a No Claims Discount (NCD) Works:

Earn NCD: Don’t make a claim for a year to earn one year of NCD.

Receive Discount: Insurers apply a percentage discount (e.g., 10-20% in the UAE) to your premium for each claim-free year, up to a maximum (e.g., 50-60% after 5-7 years).

Claim Impact: Claims reduce or reset NCD, depending on claim type (at-fault or not-at-fault) and insurer.

NCD Protection: Optional NCD protection allows limited claims without losing the discount, for an extra fee.

Transfer NCD: NCD is tied to the driver and is transferable between insurers or vehicles using a No Claims Certificate.

Note: Verify specific terms with your insurer, as policies vary.

Does my car’s registration location affect insurance costs?

Yes, your car's primary registration location or where it's predominantly driven can affect insurance costs in the UAE. While many regulations are standardized, insurers consider factors like:

Traffic Density: Dubai’s busy roads increase premiums vs. Ras Al Khaimah.

Accident Rates: Higher-risk Emirates may raise costs.

Regional Rules: Some Emirates may have unique insurance requirements.

Note: Compare quotes from different insurers to find affordable car insurance UAE for your Emirate.

Coverage Details

Does car insurance cover natural disasters in Dubai?

Not all car insurance covers natural disasters in Dubai. Comprehensive car insurance plans, like those from GIG Gulf, generally include coverage for perils such as sandstorms, floods, and earthquakes, sometimes as a standard inclusion or an optional add-on. However, vehicle insurance in the UAE usually excludes damages resulting from intentionally driving during declared natural disasters or in clearly unsafe, flooded areas. Always review your specific policy terms to confirm Dubai car insurance coverage.

Are personal belongings covered under car insurance?

Comprehensive car insurance policies such as Sukoon Comprehensive Motor Insurance, GIG Gulf Motor Prestige, and Tokio Marine Tokio Smart Plus cover personal belongings up to specified limits (usually AED 4,000 to AED 5,000). These policies cover loss or damage due to fire, theft, or accident.

Can I drive someone else’s car with my insurance?

Typically, car insurance policies are tied to the vehicle rather than the driver in the Emirates. The car's insurance policy always covers an accident, even if someone else is driving it, provided:

The driver has the owner's permission.

The driver has a valid UAE driving license (or an international license for eligible visitors).

The driver meets any conditions in the car's policy (e.g., age limits, valid license for a minimum period).

This means, you cannot drive someone else’s car with your insurance, as you don’t need it. Your personal insurance policy doesn’t typically extend to cars that you don’t own. Always confirm this with the car owner and the insurer for factual information.

Does car insurance cover rental cars in Dubai?

No, your personal car insurance doesn’t cover rental cars in Dubai. All rental cars in Dubai come with RTA-mandatory Third-Party Liability insurance, covering damages you might cause to others. You need to purchase additional car insurance policies like Collision Damage Waiver (CDW) or Super Collision Damage Waiver (SCDW) to safeguard the rental cars and yourself from any unexpected and unfortunate events, like accidents or vandalism. Rental companies arrange insurance to meet your needs from third-party insurers at premium costs. Don’t hesitate to inquire about rental car insurance while booking.

Is off-road driving covered by car insurance in Dubai?

No, in Dubai, standard car insurance policies don’t cover off-road driving. This is typically an exclusion due to the higher risks involved.

However, some insurers offer an optional "off-road" or "4x4" add-on to comprehensive policies for (AED 300-500/year). This specialized coverage is essential if you plan on activities like dune bashing or driving on unpaved terrains.

Always check your specific policy terms and conditions for coverages and exclusions. These can vary from one insurer to another.

Does my insurance cover driving in other GCC countries?

No, generally, your standard UAE car insurance policy does not automatically cover driving in other GCC countries. For cross-border driving within the GCC countries, you’ll require a “GCC Extension” or "Orange Card" on your comprehensive policy, costing around AED 150-400/year. Verify with your insurer for GCC car insurance Dubai, as terms can vary.

Claims and Emergencies

What should I do in case of an accident in Dubai?

In case of an accident in Dubai, you must:

Ensure Safety: Move to a safe spot, check for injuries.

Report to Police: Call 999 (for serious accidents/injuries) or use the Dubai Police app for minor incidents. Obtain an official police report (green for not-at-fault, red for at-fault) – mandatory for any insurance claim.

Document the Incident: Take clear, time-stamped pictures and videos of the car damage, scene, and license plate. Collect contact information and insurance details of the other party.

Notify Insurer: Contact your car insurance agency within 24-48 hours (early notification is better). Provide them with your policy number and accident details, documents collected earlier, and the police report.

Claim Insurance: File a claim with all the details required, like police report, Emirates ID, driving license, and vehicle registration (Mulkiya) information.

The insurer will arrange for damage assessment. Follow their instructions and repair your car (vehicle) at any insurer-approved workshop in Dubai.

How do I file a car insurance claim in Dubai?

Filing a car insurance claim in Dubai requires specific steps, which are:

Obtain Police Report: Report the accident (call: 999) and file an accident report. Obtain the report digitally, via email or the Dubai Police App.

Notify Your Insurer: Contact your insurance company promptly (within 24 hours) with your policy details and the police report.

Submit Documents: Submit required documents, like a police report, your Emirates ID, driving license, vehicle registration (Mulkiya) to your insurer, and evidence (photos of the damage).

File an Insurance claim: Fill up a claim form with the details as requested, verify, and submit to the insurer.

That is all you need to do to file a car insurance claim in Dubai. After that, the insurance company will arrange a vehicle damage assessment. As per their evaluation and recommended workshop, repair your vehicle.

What happens if I miss an insurance premium payment?

There are several consequences to missing an insurance premium payment in Dubai. The following are the potential ones:

Policy Lapse/Cancellation: The Insurer can suspend or cancel your insurance policy.

Legal Penalties: AED 500 fine, 4 black points, 7-day impoundment for driving with lapsed insurance policy in Dubai.

No Coverage: Significant out-of-pocket cost in cases of accidents (your car damages, injuries to yourself and others).

Higher Future Premiums: Insurers may consider you a higher risk, potentially leading to increased premiums if you try to get new coverage after a lapse.

Loss of NCD: You will probably lose any accumulated No Claims Discount.

Driving without valid insurance in the UAE is illegal. Make sure you pay your car insurance premium on time to legally drive in Dubai, escaping all traffic fines.

Can I transfer my insurance to a new vehicle?

Yes, you can transfer your car insurance to a new vehicle in Dubai. However, it depends on the insurer and the new car details.

Here's how it typically works:

Notify Your Insurer: Contact your insurer asap for insurance transfer, after acquiring your new vehicle.

Provide New Vehicle Details: Give them all the information about the new car (make, model, year, VIN, value, etc.).

Premium Adjustment: The agency will offer a new premium scheme based on your new vehicle’s risk profile. You may need to add or receive a refund on your previous premium.

Receive New Policy/Endorsement: Once the insurer finalizes the insurance premium, they will provide you with an updated policy document or an endorsement reflecting the new vehicle's coverage.

Remember, you cannot drive your new car in Dubai until the updated policy is transferred.

Niche and Expat-Specific Questions

What is takaful car insurance and how does it work in Dubai?

A takaful car insurance is a Sharia-compliant alternative to conventional insurance. It operates on principles of mutual cooperation and shared responsibility. The fundamental working principle of takaful car insurance is:

Mutual Model: Instead of paying a "premium," participants contribute to a pooled fund. If a member suffers a loss (car accident), the pool is used for compensation.

Coverage: Similar to comprehensive policy, includes accidents, theft, and third-party liability.

Providers: Salama, Noor Takaful offer plans (AED 1,200-3,000/year).

Benefit: Ethical for Muslim expats as it aligns with Islamic finance's prohibition of interest (riba) and excessive uncertainty (gharar). Any remaining money will be distributed back to the participants.

Takaful insurance policy aims for transparency and fairness.

How does car insurance work for expats in Dubai?

Most standard car insurance works the same for locals (Emiratis) and expats alike. However, the requirement will or may vary, which includes:

Driving License: Valid UAE driving license needed. Some nationalities can convert their home country license, others need to take driving tests.

Coverage: Same as locals, comprehensive, or third-party.

Challenge: Non-UAE driving history may not apply.

Factors Affecting Cost: Same for locals as well as expats.

No Claims Discount (NCD): Expats can often transfer their NCD from their home country (with a No Claims Certificate) to potentially reduce premiums.

Almost all insurance companies in Dubai offer tailored car insurance to expats.

Are electric vehicles insured differently in Dubai?

Yes, electric vehicles are insured differently in Dubai, considering their unique components and repair costs. Key differences include:

Higher Premiums (Often): EVs will have higher insurance premiums (AED 2,000-4,500/year) due to elevated pricing and pricier components.

Specialized Coverage: EV insurance policies often include battery damage/replacement and charging equipment.

Repair Expertise Cost: Specialized technicians and workshops will influence repair costs.

Potential Discounts: Insurers may offer "green vehicle" discounts for EVs' environmental benefits.

Coverage: Comprehensive or third-party, like standard vehicles.

Providers: AXA, Sukoon offer EV plans.

Always confirm EV-specific inclusions and exclusions with your insurer.

What are the penalties for driving without insurance in Dubai?

The legal and insurance-related penalties for driving without insurance in Dubai are:

Fine: AED 500

Black Points: 4 black points added to your driving license.

Vehicle Impoundment: Your vehicle can be impounded for 7 days.

Personal Liability: You are liable for all costs if involved in an accident.

Legal Complications: Potential lawsuits and other legal proceedings for sophisticated cases, like deaths.

Increased Future Premiums: Insurance companies check your driving record and charge you higher premiums, considering risk factors.

Can I get insurance for a leased car in Dubai?

Yes, you can get insurance for a leased car in Dubai. Usually, the rental agency mandates comprehensive insurance for all its leased cars. You just need to pay the premium as per your lease agreement.

Leased car insurance Dubai is available:

Requirement: Lessors often mandate comprehensive coverage.

Cost: AED 1,500-4,000/year, based on vehicle value.

Process: Coordinate with lessor, insurer (e.g., Salama).

Carefully review your lease agreement to understand who is responsible for what in cases of accidents and damages.

Choosing and Comparing Insurance

How do I choose the best car insurance provider in Dubai?

Choosing the best car insurance company in Dubai requires some insightful steps, including these factors:

Assess Your Needs: Ensure that comprehensive or third-party solution suits your needs.

Compare Quotes: Compare car insurance quotes on platforms like Lookinsure or InsuranceMarket.ae.

Consider Add-ons: Besides the basic policy, consider add-ons like personal accident cover, off-road coverage, or rental car benefits.

Insurer Reputation: Have a good understanding of the insurer's financial stability, claim settlement ratios, and customer satisfaction. Use Google reviews, Reddit, or Play Store or App Store reviews.

Deductibles & Premiums: A higher deductible means a lower premium, but higher out-of-pocket costs in a claim. Try to balance your annual premium with the deductible amount.

Customer Service: Evaluate customer service efficiency, as it is very important during an accident or claim. Customer reviews clearly elaborate on this.

Pick an insurance provider that meets your insurance expectations. Don’t settle for good, delve deep to find the best.

What are the top car insurance providers in Dubai?

Picking the top car insurance provider in Dubai is a difficult task as preferences vary from one person to another. However, considering rental agencies’ reputation and customer reviews, the following are the top five (5) car insurance providers in Dubai:

Sukoon Insurance (formerly Oman Insurance Company)

GIG Gulf (previously AXA Gulf)

Orient Insurance

Tokio Marine

Salama Takaful (a leading Sharia-compliant option)

Note: Anyone can debate this ranking, as they might prefer some other agencies, like Union Insurance, Dubai National Insurance Company (DNIC), or Liva Insurance. It’s a personal choice, but facts don’t lie.

Should I auto-renew my car insurance policy?

Auto-renewing car insurance in Dubai offers convenience and avoids illegal coverage gaps.

However, it's not always recommended due to:

Potential Price Hikes: Premiums can increase upon renewal without notice.

Missing Better Deals: You might miss competitive offers and discounts from other insurers by not comparing annually.

New Options: You won't explore updated plans or new providers like Sukoon.

Manually renewing allows you to compare quotes (e.g., on Lookinsure) and secure better rates or more suitable coverage, potentially saving up to 20%. Set reminders to ensure timely renewal and avoid penalties.

What documents are needed to buy car insurance in Dubai?

To purchase a car insurance policy in Dubai, you’ll need:

Emirates ID: Proof of identity.

UAE Driving License: Valid for residents (expats) & locals.

Residence Visa Copy: For expatriates, to verify identity and legal residency

Vehicle Registration: Mulkiya copy.

No Claims Discount (NCD) Certificate: If claiming No Claims Discount.

Some insurers might demand additional paperwork such as a car purchase invoice, previous policy details, etc., especially if you’re transferring to a new insurer.

Additional Tips and Resources

What are the common mistakes to avoid when buying car insurance in Dubai?

Some common mistakes you need to avoid when purchasing car insurance in Dubai are:

Under-insuring your vehicle: Get the best insurance valuation for your car. It’ll be exceptionally useful in cases of total loss.

Ignoring policy exclusions: Exclusions are important as they tell you what not to do with your car, like off-roading and specified modifications.

Not comparing quotes from different insurers: Getting the best value for the same premium must be your goal. Research and compare quotes on the web, don’t settle for what’s in front of you.

Falsifying information: False information will entirely and immediately invalidate your policy. Always provide accurate and correct details.

Overlooking deductibles: Don’t always go for higher deductibles for the sake of lower premium. During accidents and damages, you’ll face its consequences with higher out-of-pocket expenses.

Neglecting customer service reputation: Company reputation matters a lot. Always go with the best insurers, like Sukoon Insurance.

How often should I update my car insurance policy?

You must review and update your car insurance policy UAE annually, as it aligns with 12-month insurance validity:

Key times to review and update include:

Annual Renewal: Check for better rates, new coverage. Most insurers give you an extra 1 month, as a grace period, making your insurance valid for 13 months.

After Significant Changes:

Transferring insurance to a new car.

After major modifications, affecting the car's value or performance.

Changes to the primary driver or adding new drivers.

Significant changes to driving habits or location.

RTA Compliance: Ensure mandatory coverage per RTA regulations.

Note: Shop around and compare offers from different insurers to find better deals or more suitable coverage.

Conclusion

Car insurance policies are your safety net while driving in Dubai if anything goes south. From personal injuries and property losses to third-party damages and fatalities, car insurance Dubai saves you from significant monetary losses and stresses. With our 25 FAQs on car insurance in Dubai, you’ve now clearly understood the importance of insurance policies, cost & saving factors, claims & emergencies, and insightful tips to make your car insurance selection and renewal easier in the Emirates. You now know how to keep your insurance updated with cost-effective methods and drive legally in the UAE. Stay updated, be proactive with car insurance, and stay connected for the latest car insurance Dubai updates.

Written by: FriendsCarRental

Published at: Fri, May 30, 2025 11:56 AM

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 5500

DAY

AED 0

MONTH

-

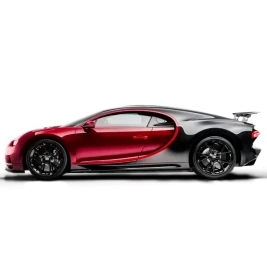

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana