Top 5 Car Finance Providers in the UAE – Rates, Requirements, Reputation

In the UAE, the key to unlocking the car of your dreams isn't just the down payment—it's securing the right car finance. However, with so many banks and diverse terms, landing the absolute best deal can be an overwhelming task. But you need not worry anymore. This guide does the hard work for you. We have analyzed the offers from the biggest financial institutions in the Emirates to identify the Top 5 Car Finance Providers based on what matters most: the lowest profit rates (flat p.a.), the minimum salary required, and the fastest approval times. Get ready to compare the best options side-by-side and confidently move from shopping to driving.

Note: All rates are indicative and subject to your final profile and credit score.

Non-Negotiable UAE Car Finance Rules

Before diving into the top car finance providers in the UAE, let’s understand the non-negotiable fundamentals. Before you submit your application, you must meet the non-negotiable legal mandates enforced by the Central Bank of the UAE. These rules ensure regulatory compliance and apply to all banks and financial institutions in the Emirates:

Minimum 20% Down Payment

The Central Bank stipulates that financing cannot exceed 80% of the car's value. This means you must have readily available funds to cover a minimum 20% down payment.

Maximum 60-Month Tenure

The longest permitted repayment period for any individual auto loan or car finance agreement in the UAE is 60 months (5 years).

Best Car Loans in the UAE: Top 5 Banks Comparison

Your smartest financial decision starts here. We've compiled a ranked, at-a-glance comparison of the UAE's leading financial institutions, focusing on starting flat rates, minimum salary requirements, approval times, and unique advantages to perfectly match a car loan to your budget.

Note: Rates are indicative for new cars, calculated on the full loan amount, and vary based on your income, loan tenure, and banking package. Salary requirements may vary for non-listed companies.

In-Depth Look at UAE’s Top Car Finance Providers

Beyond the numbers, this is where you decide. Having seen the summary, dive into the unique offerings, core strengths, and specific reasons behind the ranking of each of the UAE's top five car finance providers to ensure the best fit for your financial journey.

1. Emirates Islamic (EI)

Emirates Islamic secures the top rank by offering one of the lowest starting profit rates in the market (1.89% flat p.a.). This alone makes it the premier choice for customers prioritizing competitive Sharia-compliant financing. EI is highly regarded for its accessible application process and commitment to Islamic banking principles.

Key Highlights: Market-leading low profit rates, Sharia-compliant Murabaha structure, and competitive financing for both new and used vehicles.

Reputation Snapshot: Highly favoured for offering the strongest rate within the Islamic finance sector, often sought out by value-conscious customers.

2. Dubai Islamic Bank (DIB)

DIB ranks highly for its exceptional accessibility, featuring a market-low minimum salary requirement of just AED 3,000. This focus on broader eligibility makes DIB a crucial option for a wider range of customers seeking Sharia-compliant auto finance.

Key Highlights: Lowest minimum salary entry point, flexible terms, and non-mandatory salary transfer options.

Reputation Snapshot: Reputable for its market-leading accessibility and commitment to bringing car finance options to entry-level professionals.

3. First Abu Dhabi Bank (FAB)

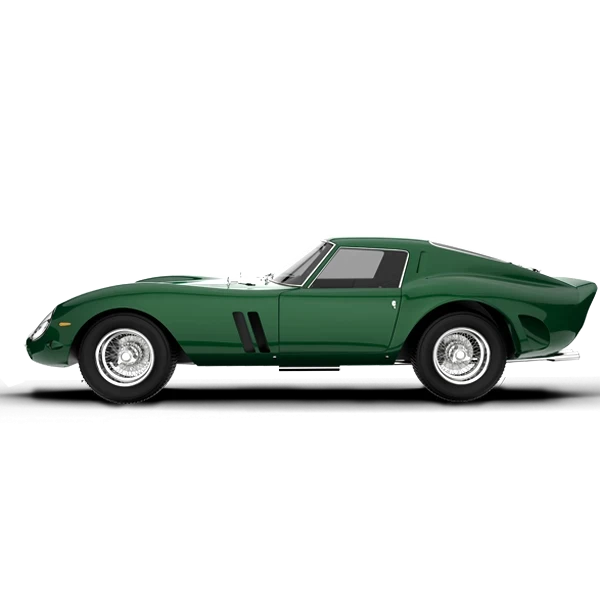

As one of the UAE's largest financial institutions, FAB provides comprehensive financing options tailored for high-value purchases. With a starting rate of 2.15% and high loan amounts (up to AED 1.5 Million), FAB is the ideal choice for customers looking to finance luxury or high-end vehicles with competitive conventional terms.

Key Highlights: Highest loan ceiling, competitive flat rates, and a 90-day grace period before the first installment.

Reputation Snapshot: Professional service and strong financing options, particularly for customers with high salaries.

4. Emirates NBD (ENBD)

Emirates NBD stands out for its digital focus and speed. While its advertised starting rate is higher than others, the bank is a market leader in processing efficiency. It offers rapid approvals—often within 24 hours—for pre-qualified customers. This emphasis on convenience and fast digital journeys makes it a preferred choice for quick transactions.

Key Highlights: Fastest digital approval process, extensive dealership network, and special subsidized pricing for UAE Nationals.

Reputation Snapshot: Recognized for robust digital platforms and generally clear, fast service agreements.

5. Abu Dhabi Commercial Bank (ADCB)

ADCB is ranked fifth but offers some of the most competitive conventional rates, starting from 1.99% flat p.a. It is praised for its efficient one-signature application process and strong reputation among high-net-worth customers. It also offers a reliable financing solution, particularly for those with a higher minimum salary.

Key Highlights: Highly competitive conventional rates, quick approvals, and a customer-friendly digital experience.

Reputation Snapshot: Highly favoured for transparency and speed in processing auto loans for salaried individuals.

Flat Rate vs. Reducing Rate: Why This % is Critical?

The distinction between Flat Rate and Reducing Rate is critical in car finance. It dictates the total amount of interest you will pay over the life of your loan, as a low Flat Rate percentage is equivalent to a Reducing Rate that is twice as high.

The key to understanding the cost difference is realizing that a Flat Rate is not the same as a Reducing Rate, even if the percentage numbers look similar.

Take a look at the difference in interest calculation:

FAQ

1. What are the documents required for a UAE car loan application?

The documents required for a car loan application in the UAE include the following documents:

Original Emirates ID and a copy.

Passport copy with UAE residence visa page (for expatriates).

Valid UAE Driving License copy.

Salary Certificate/Letter of Employment (dated no more than 30 days old).

Last 3 to 6 months' Bank Statements (depending on the bank's requirement).

Proforma Invoice or Valuation Certificate for the car (from the dealer/seller).

2. Is a down payment mandatory for a car loan in the UAE?

Yes, 20% down payment is mandatory for a car loan in the UAE. The Central Bank only allows up to 80% of the car value financing.

3. Can I get a car loan for a used car?

Yes, most banks offer finance for used cars, but there are strict limitations on the vehicle's age at the time of the final installment. Generally, the vehicle's age plus the loan tenure cannot exceed 7 to 8 years. The loan tenure (2-3 years) can be shorter compared to a new car.

4. What are the common fees and charges associated with a car loan?

The common fees and charges associated with a car loan are:

Processing Fee: A one-time charge, usually capped at 1% of the loan amount (AED 500 minimum, AED 2,500 maximum).

Car Registration Fees: Costs associated with registering the vehicle in your name with the RTA.

Mandatory Comprehensive Insurance: The car must be fully insured for the loan duration, and the bank is typically the beneficiary until the loan is paid off.

Early Settlement Fee: If you decide to pay off your loan early, the fee is capped at 1% of the outstanding loan amount (AED 10,000 maximum).

5. Can I pay off my car loan all at once?

Yes, you can absolutely pay off your car loan all at once in the UAE. This process is called early settlement or pre-payment, and it is your legal right as a borrower. However, you will incur a fee for doing so, which is governed by UAE Central Bank regulations to protect the financial institution's lost interest revenue.

Early Settlement Fees:

Maximum Penalty Fee: 1% of the outstanding loan amount.

Statutory Cap: Typically AED 10,000 or (whichever is lower between the 1% and the AED 10,000 cap).

Final Thoughts

A successful car finance decision in the UAE depends less on the lowest numerical rate and more on a holistic evaluation of the lending package. Prioritize the bank's reputation for transparent processing and reliable customer service over marginal savings. Crucially, choose between a Conventional or Sharia-compliant Islamic Finance product to align with your personal values and long-term financial structure. Additionally, examine the fine print for flexible features, such as payment deferrals or non-mandatory salary transfers, which enhance your financial freedom. Ultimately, the best auto finance secures both your vehicle and your peace of mind.

Written by: FriendsCarRental

Published at: Mon, Nov 17, 2025 2:06 PM

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

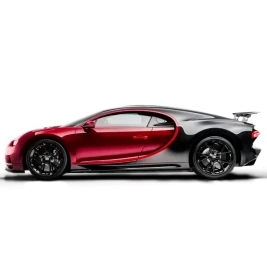

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana