What Happens If You Leave UAE Without Paying Your Rental Car Payment?

Skipping your UAE rental car payment might not seem a big

deal at a glance. It’s an illusion—don’t fall for it. Leaving UAE without

settling your dues can lead to serious consequences—from future UAE travel bans

to potential arrests. If you ever are in such a situation, don’t flee. There is

always a way out—you just need to know where to look. This article breaks down

the governing rules and risks (immediate and future) of unpaid rental car UAE.

It also offers you practical tips and prevention methods. Stick to the end and

learn to navigate around UAE rental car laws.

Let’s get started:

Understanding the Risks of Unpaid Rental Car Debts

The UAE rental car non-payment isn’t just about money—it

extends to unimaginable disruptions. It can haunt you beyond your trip. From

legal UAE debt collection cases to travel ban debt—it can hit your finances and

future travel—hard. Here’s what the rental car debt UAE consequences look like

(both for tourists and residents).

How Rental Companies Respond to Non-Payment

Rental companies will trigger a series of legal actions

against you for unsettled payments. Since they have your personal and contact

details (taken during rental), they’ll bombard you with emails and phone calls.

If you had used a credit card for initial payment, they would try charging it.

They have contractual rights to do so.

If no avail, they will file a police complaint. This is

serious and you will bear the consequences. With the help of UAE debt

collection firms, agencies can pursue you overseas too. If you manage to dodge

them, they will blacklist you from renting cars in the UAE.

Potential for a Travel Ban

But the more serious consequence is the UAE travel ban.

With an existing police case against you, you will surely face UAE immigration

issues. The Emirates government will ban you from re-entering the country,

potentially derailing your travel routes and plans. The severity of the travel

ban is entirely up to the authorities, more than rental companies.

Not all formal complaints escalate to travel ban—but

threats are possible. The higher the amount, the longer the ignored debt—more

serious are the consequences.

Rules Governing Car Rentals in the UAE

The UAE car rental laws clearly bind both parties:

renters and rental agencies. Rental contracts and agreements outline the

obligations for the renter. Every renter should put a pen to the paper binding

them to every rule scripted. Renters’ obligation is to make a complete payment

while returning the car. Payments via cash, bank transfers, or digital wallets

are possible.

Car rental debts automatically tie with renter’s

passports (tourists) or Emirates IDs (residents). As all vehicle rentals link

with Dubai RTA, the renter-vehicle association is legal and official. No renter

can deny it. Therefore, making them liable for all rental-related payments like

Salik (tolls), parking fees, late return fees,

traffic fines, and so on. On the rental agencies’ side, they must follow UAE

consumer laws, ensuring complete transparency in fees and agreements.

Unsettled rental debt disputes fall under civil law.

These laws apply to every renter—both short-term and long-term—tourist or

resident. Familiarizing yourself with the rental terms and agreements will help

you navigate UAE car rentals without surprises. Meet your obligations and stay

clear of troubles.

Rental Debt Issues in Dubai and Abu Dhabi

Dubai’s ever growing tourism industry brings ups and

downs in its vehicle rental industry. The ever buzzing rental industry relies

on well-structured information to settle the rental-related issues, like unpaid

car rental debt. Dubai RTA’s seamless platform for rental companies combined

with agencies’ enhanced monitoring systems, flags every payment-related detail.

This simplifies quick recoveries and filing reports against anyone trying to

finesse the Dubai car rental issues.

Abu Dhabi rental debt cases also follow similar steps,

leaning on government systems to track and report unpaid rental debts. Both the

emirates operate under the similar UAE car rental laws. However, Abu Dhabi’s

rules can be even more restricting than that of Dubai. The consequences for not

paying rental fees might also come with greater impact in Abu Dhabi. Prepare

yourself accordingly—Dubai’s high speed or Abu Dhabi’s strict

approach—unsettled rental debts never go unnoticed.

What to Do If You Can’t Pay Before Leaving

There may arise situations where you might not be able to

pay rent in full. For instance, you got into an accident and damaged the car,

and don’t have insurance to cover. Rental companies will charge you for damage

repairs and booking loss on top of your rental fees. Here are some steps you

can take to avoid UAE rental car debt escalation:

- Reach out to your rental agency in advance. Call them to

discuss your situation. In person discussion is even better. Explain to them

your situation honestly and clearly. Communication is key.

- Inquire about potential alternative payment methods or

arrangements. Request for payment in installments or over time. They might come

up with a suitable solution to your problem. Using a guarantor (if available)

can help.

- If you reach an agreement, get everything in writing.

Ensure it is documented in ink (email also works). Authorized company

representative acknowledgement and signature on the agreement is recommended.

- Seek legal assistance if necessary. Things might not go

as planned, so a legal representative can help you navigate through the

situation. However, a solution is not always guaranteed.

- Your countries’ embassy or consulate can be your final

resort, if you are left with no options. They might not be able to help you

directly. But they can guide you with local laws and connect you with legal

resources.

Preventing Rental Payment Problems

It’s better to be safe than sorry. With some careful

assessment and planning, you can flawlessly prevent UAE rental car payment. These

proactive steps can guide you through a stress-free rental experience:

- Research and pick rental agencies that are transparent

with their service and charges. Transparency goes a long way. Choosing the

right agency will help you avoid disputes regarding rental payment.

- Read the rental agreement thoroughly before signing it.

Know what you are signing up for. Consider even the tiniest details, from

hidden fees to extra charges. Make everything clear—ask the agents to clarify

wherever needed.

- Consider your

budget well before renting a car in the UAE. Choose cars that match your pocket

size. Make sure you can cover expenses without any difficulty. Don’t forget to

consider extra expenses that may occur during your rental period.

- Clarify what payment methods the rental agency accepts.

Credit cards, debit cards, cryptocurrencies, bank transfers, digital wallets,

and so on. Also understand if they hold security-deposits and release periods.

- Choose insurance like collision damage waiver or similar

to safeguard yourself from potential accidents and car damages. Different insurance policies for rental

cars are available in the UAE.

- Inspect the vehicle in detail before hitting the road.

Document damages so that agencies don’t rip you off for existing damages. Take

steps to reduce extra payments, such as traffic fines and late returns.

- Some rental companies may offer discounts on full upfront

payment. Take advantage of such offers to save some extra money.

Final Thoughts

Understand the risks of unpaid car rental debts well

before you act—flee the country. They come with serious consequences, which

sometimes can involve cross-border UAE debt collection firms and even legal

complaints, potentially derailing your future travel plans. It’s not wise to

finesse a rental company as you’re now armed with insights on rules, regional

quirks, and smart steps to steer clear of tourist debt UAE or expat debt UAE

through effective communication. More importantly, with proper planning and the

advice above, you can easily avoid rental payment problems and enjoy the UAE’s

roads with confidence. Therefore, always ensure your rental obligations are met

before departing the UAE to avoid these serious repercussions and secure a

smooth ride.

Written by: Friends Car

Published at: Sun, Apr 13, 2025 6:43 PM

Leave a Reply

Your email address will not be published. Required fields are marked *

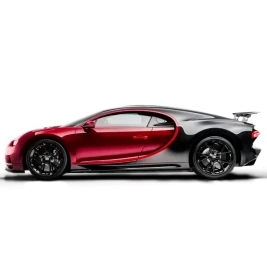

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

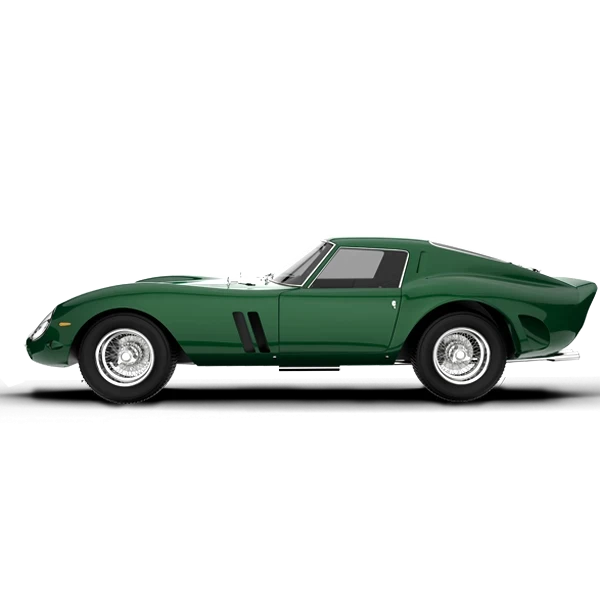

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

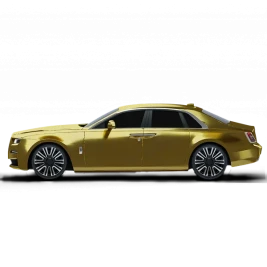

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana