Can You Drive with Expired Car Insurance for Just a Day in the UAE?

You are here because you have been wondering, Can I drive in UAE with expired insurance for just a day? The simple answer is an emphatic NO, you cannot. This common query reflects a massive, yet often misunderstood, risk in the UAE. This misunderstanding tempts drivers to take a chance on the road for just a few hours, but the legal and financial cost of that single day is astronomical. So, what is the exact law for expired vehicle insurance in the UAE? This article explains precisely why driving a car without insurance, even for a single day, is illegal in the Emirates. You will also learn the root cause of all this confusion. Let’s get started.

The Root Cause of Confusion: Insurance vs. Registration (Mulkiya) Grace Period

Many drivers in the UAE dangerously mistake the grace period offered for the annual Vehicle Registration (Mulkiya) for their compulsory car insurance. This is the single biggest misunderstanding that fuels the "one-day" risk. While the RTA grants a grace period for your registration, your insurance policy must remain valid throughout this time. You cannot afford to confuse these two documents.

Check these pointers for clarity:

1. The Grace Period is for the Mulkiya, Not the Insurance

● The 30-day grace period is a courtesy offered by the RTA (Roads and Transport Authority) only to complete your annual vehicle inspection and registration (Mulkiya) paperwork.

● The Law is Clear: To even start the registration renewal, your car must have valid insurance. The grace period does not cover expired insurance.

2. Why Insurance is Valid for 13 Months

● UAE car insurance policies are sold for 13 months, not 12.

● This extra month is simply a pre-paid feature of your policy. It is designed to cover the same 30-day window the RTA gives you for your registration renewal.

● It is NOT an extension you can use after your 13-month policy has lapsed. Once the 13th month is over, your insurance expires, and driving your car is illegal.

Understanding the difference can help you stay away from several types of severe and avoidable consequences—ranging from immediate legal fines to catastrophic financial liability in the event of an accident. To understand the full price of this mistake, you must know exactly what happens the moment you are caught driving an uninsured vehicle.

The Immediate Legal Consequences

The belief that you can drive for a single day after your insurance expires is not just a gamble—it is a clear violation of UAE Federal Traffic Law. The penalties are immediate and apply the moment your policy lapses, not after a grace period.

If you are stopped by police or detected by smart traffic systems driving a car without valid insurance (even with valid registration), you will face serious sanctions:

Crucially, these immediate legal consequences are only the first layer of the risk. They are imposed simply for driving without insurance. The far more severe consequences occur if you are involved in an accident.

The Catastrophic Financial Risk: In Case of an Accident

The real threat of driving with an expired insurance surfaces in the event of a car accident. Without insurance, you move from being a driver to an uninsured party, making you personally and fully liable for every single cost resulting from the collision.

These financial liabilities fall into three catastrophic categories:

1. Vehicle and Property Damage Costs

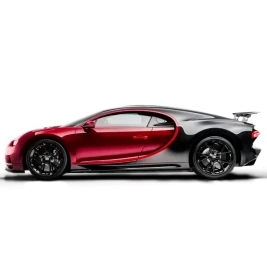

In Dubai, where luxury and high-value cars are common, a minor fender-bender can quickly turn into a five or six-figure debt.

● Third-Party Repairs:

You are responsible for the full repair or replacement cost of the other party's vehicle. If you cause an accident with a car worth AED 500,000, and it is deemed a total loss, you will be personally liable for that entire amount, which must be paid out-of-pocket.

● Your Own Vehicle:

Any damage to your car is your problem entirely. There is no insurance claim, meaning you pay for all spare parts, labor, and mechanic fees directly from your savings.

● Public Property Damage:

You will also be billed for any damage to public property, such as guardrails, streetlights, or road signs.

2. Medical and Compensation Costs

If the accident results in injury, the financial burden is staggering, as you must cover all medical, legal, and compensatory damages for the victims.

● Medical Bills:

You must cover 100% of the injured party’s medical expenses, from emergency room treatment and surgery to long-term rehabilitation. In the UAE, these costs can quickly reach hundreds of thousands of dirhams.

● Loss of Income:

You may be liable to compensate the injured party for any wages they lose while recovering from their injuries.

● Blood Money (Diya):

In the tragic event of a fatality, the court will impose the Sharia Law-based compensation known as Diya (blood money). The standard minimum amount for involuntary manslaughter is AED 200,000, which is payable directly to the family of the deceased. If you are uninsured, this amount is entirely your personal responsibility.

3. Legal and Personal Consequences

If the costs are substantial and you cannot pay (which is likely, given the scale of the financial liability), the case moves from a traffic violation to a civil and potentially criminal matter.

● Lawsuits:

The victim's insurance company or the family of the deceased will pursue a lawsuit against you to recover their compensation. This can lead to a lengthy and costly legal process.

● Travel Ban and Imprisonment:

If you are found liable and fail to pay the court-mandated compensation—be it for vehicle damage, medical bills, or Diya—a travel ban will likely be imposed. You could face imprisonment until the debt is settled.

In essence, driving without valid insurance in the UAE means you are trading a small, mandatory annual fee for a potential lifetime of catastrophic debt.

FAQs

1. Can traffic cameras detect an expired car registration (Mulkiya) in the UAE?

Yes, smart traffic cameras and radar systems installed across various emirates, including Dubai, Abu Dhabi, Ajman, and Ras Al Khaimah, are capable of automatically detecting vehicles with expired registration plates and issuing fines without human intervention. This is a common method of enforcement for this violation.

2. What is the fine for driving a car with expired registration in Dubai, UAE?

The fine for driving a vehicle with an expired registration in Dubai is AED 500, accompanied by 4 black points on the driving license, and the vehicle will be impounded for 7 days.

3. How far in advance can I renew my car insurance in the UAE?

You can generally renew your car insurance policy up to 60 days (or two months) before its expiry date.

Learn more about car insurance: 25 Most Asked Questions About Car Insurance in Dubai

Final Thoughts

The answer to driving with expired insurance for just a day in the UAE is a definitive no. Understanding the fundamentals of confusion: insurance vs registration grace period is absolutely mandatory.

Your insurance must be valid 24/7. Failing this exposes you to immediate fines, black points, and the unimaginable financial ruin of an accident. Without coverage, you alone bear the cost of property damage, medical bills, and potential court-mandated compensation.

Protect your financial future and stay compliant. In the UAE, there is no grace period for expired insurance, only catastrophic consequences.

Written by: Friends Car

Published at:

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana