Car Financing for Expats in the UAE – What Banks Don’t Tell You

Planning to apply for a car loan in the UAE? You will find a lot of top-rated car finance providers in the Emirates. While the choices are abundant, don’t get carried away, understand the core fundamentals, often overlooked. These are the secrets—what banks don’t tell you; and are absolutely crucial for car finance seeking expats in the UAE.

Don’t fall for attractive advertisements; unravel these subtle, critical financial constraints and the internal policies before submitting your application. So how do you do that? It’s easy. Let’s explore the six crucial truths that car financers tell you only when you ask. Equip yourself with all the necessary information you need to negotiate better terms. Avoid expensive, common pitfalls hidden deep within the bank's fine print.

Six Crucial Car Finance Truths Banks Don't Readily Tell You

Securing ideal car finance in the UAE requires knowledge of market subtleties and avoiding hidden surprises. It absolutely demands an in-depth knowledge of the UAE car loan market. Understand these six hidden truths to dictate your borrowing power and ensure the best possible outcome.

#1. The True Cost of Your Interest Rate

Know the deliberate confusion between two types of interest rates: Flat Rate & Reducing Rate, used by UAE banks. There is a massive difference between an advertised rate versus the rate that determines the loan's real expense.

What Banks Tell You:

UAE banks will prominently advertise the lowest possible figures available to effectively capture your attention. They often use a Flat Rate of interest, which is presented as a percentage per annum, such as 2.5% or 3.0%. These specific misleading figures are, in fact, frequently emphasized in all their official promotional materials.

What Banks Don’t Tell You:

They do not clearly highlight the actual effective rate, known as the Reducing Rate or APR, in the main advertisement. The difference between those two distinct rates is actually very significant.

What’s the Actual Truth:

The actual reality is that a Flat Rate is only used for simplified calculation purposes on the original principal amount. The Reducing Rate is the true effective cost and is significantly higher (typically 4% to 7%). These are double the advertised rates. Banks use this rate to calculate the interest paid on your outstanding balance each month.

Crucial Point to Takeaway:

Always demand to see the Annual Percentage Rate (APR) before signing any documents. You will learn about the real interest you will be paying over the complete loan duration.

Pro Tip: Despite the fact that the Reducing Rate (RR) number is higher, the RR method ensures you pay a lower overall interest cost than a true Flat Rate (FR) loan.

2. The Final Authority: Debt Burden Ratio (DBR) Limit

This is a core regulatory constraint enforced by the UAE’s Central Bank that directly governs your eligibility for a new car loan. This specific rule determines the maximum amount of debt allowed in reference to your monthly income. It’s an insightful measure to protect you from heavy financial burden.

What Banks Tell You:

Banks only focus on your minimum salary and job stability as the main factors for qualifying for the loan. If you meet the income requirement, they imply your loan application is highly likely to be approved.

What Banks Don’t Tell You:

Your monthly income/salary is not the only determining factor for the approval of your car finance application. Actually, your total outstanding debt is the most critical element that decides approval. This is including the car loan you’re currently applying for.

What’s the Actual Truth:

The Central Bank enforces a strict Debt Burden Ratio (DBR) limit, meaning your total monthly debt payments—including this new car loan and all credit cards—cannot exceed 50% of your gross monthly salary/income. So, if your total monthly payment exceeds half of your salary, your car loan application will be rejected with certainty.

Crucial Point to Takeaway:

Calculate your total current debt payments and ensure they are well below 50% of your income. If it’s not the case, don’t bother applying. First, reduce your monthly payments and then apply. This will significantly increase your car loan approval chances.

3. Early Exit Fees and Mandatory Insurance Tie-ups

The bank’s fine print contains crucial clauses regarding loan settlement and required comprehensive insurance coverage. These details determine unexpected costs if you modify your loan or select an outside insurer.

What Banks Tell You:

They advertise flexible repayment plans and emphasize the necessity of comprehensive insurance coverage. Many banks strongly steer you toward their in-house Takaful or insurance partner, whose premium may be slightly higher than the market's best available price. They assure you that the loan terms are designed to be convenient.

What Banks Don’t Tell You:

There is a punitive financial cost if you decide to pay off your entire car loan early. They also do not openly encourage you to source your car insurance from external providers.

What’s the Actual Truth:

An early loan settlement incurs a financial penalty, which is generally capped at 1% of your remaining principal balance or a fixed fee, whichever is lower. Furthermore, banks often pressure or require you to purchase their in-house Takaful/Insurance, which might not be the market's most cost-effective option.

Crucial Point to Takeaway:

Read the early settlement clause carefully to understand the exact fee. Always compare the bank's mandatory insurance quote with at least two external quotes.

4. The Unofficial Impact of a Bounced Cheque

A single previous financial misstep, even if fully resolved, can elevate your internal risk classification with the bank. This factor can then be used to demand a higher interest rate on the car finance.

What Banks Tell You:

They focus on your current employment stability and the requirement for a clear current credit bureau report. A resolved issue should not be a problem.

What Banks Don’t Tell You:

Their internal risk assessment uses historical data that goes deeper than the current credit report score. A past bounced cheque creates a lasting red flag on your file.

What’s the Actual Truth:

A previous bounced cheque increases your internal risk rating significantly, even after the issue is fully settled. This elevated risk is used by the bank to justify either a direct rejection or offering a higher, non-preferential interest rate.

Crucial Point to Takeaway:

Be prepared for tougher scrutiny if you have any history of financial defaults. Get ready to negotiate the offered interest rate based on your current stability.

5. The Employer Tier System and Its Effect on Rates

The bank’s confidential classification of your employer is one of the most powerful and secretive factors in determining your ultimate interest rate. This is an exclusive factor that overrides personal salary in many cases.

What Banks Tell You:

They state that the interest rate is based on your salary and individual credit profile. They make it sound like the rate is standardized for all customers who meet the minimum criteria.

What Banks Don’t Tell You:

They classify your employer into an internal risk-based tier system before even looking at your application form. The tier determines your risk before your salary is even assessed.

What’s the Actual Truth:

Employees of Tier 1 companies (government, large multinational corporations) are deemed the lowest risk. This immediate status grants those employees the absolute best, lowest advertised interest rates and the quickest approval times available in the entire market.

Crucial Point to Takeaway:

If you work for a highly-reputable company, use that information as leverage to negotiate a better rate. You are likely eligible for their most preferential pricing.

6. The Risk of Negative Equity Due to Depreciation

The financial danger of the vehicle's rapid loss of value compared to the slower reduction of your outstanding car loan principal is crucial. This can become a major issue in a few situations, like selling the car early.

What Banks Tell You:

They assure you that the car itself serves as their primary collateral for the finance. They emphasize the benefits of low monthly instalments over a five-year repayment term.

What Banks Don’t Tell You:

The rapid depreciation of your vehicle's market value, especially a new one, is something they will never warn you about. This creates a financial risk, which will never be mentioned.

What’s the Actual Truth:

For the first two to three years of your loan, the market value of your car will usually drop faster than your outstanding loan principal. This means you are in a state of negative equity. In this stage, you owe the bank more money than the car is currently worth if you try to sell it now.

Crucial Point to Takeaway:

If you need to sell the car early, you may be forced to pay the difference between the sale price. You might need to pay the remaining loan amount out of your own pocket. This could be thousands of dirhams.

FAQs:

#1. What is a security cheque and why does the bank require one for a car loan?

The security cheque is an undated, post-dated cheque that the bank requires you to sign for a value typically covering 110% to 120% of the total loan amount. Its primary purpose is for the bank to retain a legal right to seek a claim against you in the event of default on payment. It serves as a powerful deterrent against non-payment, providing the bank with a secured legal mechanism to recover their funds if necessary.

#2. Do I need a mandatory down payment, and can I finance the full car price?

Yes, the UAE Central Bank enforces a mandatory minimum down payment requirement. For car loans, you are generally required to pay at least 20% of the car's value as a down payment. This means you can only finance a maximum of 80% of the vehicle's price. You cannot finance the full 100% of the car's price directly through a car loan.

#3. What happens to my loan if I lose my job or change employers in the UAE?

You must immediately notify your bank of any change in employment status. If you secure a new job, the bank will require a new salary transfer letter and a job continuity check. If you become unemployed, the bank may ask you to find a guarantor or submit a lump sum payment until a new job is secured, as the lack of a salary transfer will trigger a default review.

Final Thoughts

Now, securing a car loan in the UAE will no longer be a confusing or financially detrimental experience. Your strongest tool in the entire negotiation process is knowledge, particularly the understanding of the above six crucial truths, which banks prefer to keep hidden.

By equipping yourself with a clear understanding of these rules, you immediately shift the power dynamic in your favor. Do not sign any document unless you have clarified every single fee and read all the fine print very carefully.

These steps ensure that you navigate the car finance landscape confidently and drive away with the most favorable terms available.

Written by: Friends Car

Published at: Tue, Dec 30, 2025 4:00 PM

Leave a Reply

Your email address will not be published. Required fields are marked *

Car Rental in Dubai

AED 2500

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

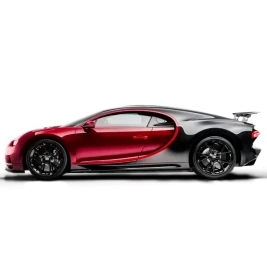

AED 5500

DAY

AED 0

MONTH

-

Sports

Sports -

2 Doors

2 Doors -

2 Seats

2 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1200

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1600

DAY

AED 0

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

AED 1500

DAY

AED 28500

MONTH

-

SUV

SUV -

4 Doors

4 Doors -

5 Seats

5 Seats

- 1 Day Rental Available

- Deposit: Not Required

- Insurance Included

عربي

عربي

English

English

Français

Français

Русский

Русский

中国人

中国人

Nederlands

Nederlands

Española

Española

Türkçe

Türkçe

Italiana

Italiana